In 2021 KBC announced that it will cease operations in Ireland. Shortly after this, it was also announced that KBC had entered a legally binding agreement with the Bank of Ireland (BOI) meaning BOI would acquire all of KBC Ireland’s performing loan assets. But what does this mean for KBC bank customers? And how do you close your KBC bank account in Ireland?

We have answered the most popular questions surrounding the KBC bank closure in Ireland and what you need to know as a KBC customer including how to close a KBC bank account and what happens if you don’t close it.

How do I close a KBC account in Ireland?

From the beginning of June 2022, KBC began issuing current customers a 6-month notice to close their KBC accounts. Before you go ahead and close your account, however, it’s important to make sure everything is in order to avoid any complications down the line. Some questions to ask yourself include:

- Is my balance empty?

- Have I any direct debits coming through my account that I need to update?

- Have I all the relevant banking documents that I might need in the future?

- What payments come directly into my account? Who will I need to notify?

Once those crucial questions are answered and addressed, you can take the next steps toward closing your KBC account. According to KBC, you will need to post a signed written statement requesting that your account be closed to the following address:

KBC Bank Ireland,

Sandwith Street,

Dublin 2

This covers current and deposit accounts as well as credit cards – email copies will not be accepted. In the letter you will need to include:

- Your name

- Your account number

- Your signature

It’s important to note that they advise you have another bank account set up for your daily banking before you close your KBC bank account. If you are on the lookout for a secure and reliable current account, find out more about setting up a digital account with Money Jar here.

Are KBC customers now with Bank of Ireland?

KBC’s current accounts will not be moving to the Bank of Ireland which means if you have a current account with KBC, you should begin looking for a new provider to switch to.

If you are a mortgage borrower or have a loan with KBC, it is recommended to reach out to the KBC team directly to see what your best options are and what next steps to take.

Can you close a KBC account without going to the bank?

At the moment, the only way to close a bank account with KBC is through a written statement. If you have any questions or queries regarding this, reach out to their customer care team directly on 1800 93 92 44.

What happens to my KBC account if I don’t close it?

As a KBC customer, you should expect to receive a letter notifying you of the date your account will close. KBC note that you don’t need to take any action until you receive this letter – they plan to issue these on a phased basis continuing into the beginning of 2023 so if you haven’t received one yet, don’t fret!

When you do receive a letter, it’s advised to open an account with a new provider and ensure that you have moved your payments and money to make the process as seamless as possible.

How do I switch bank accounts?

If you are hoping to switch your KBC bank account the good news is – it’s not that complicated! In fact, with the switching service available across nearly all of the Irish banks, all you will need to do is choose your new provider, open a current account with them and fill out an account transfer form. For insights into other banks and to compare services, you can find out more here.

Don’t forget to choose a switching date where there is little activity in your account and not a time when you are expecting payments or direct deposits to come through.

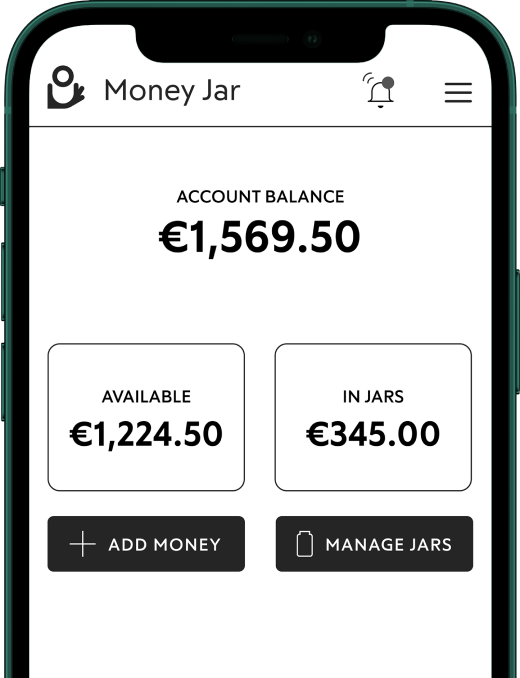

On the lookout for a new and secure digital account? Money Jar offers a simple and straightforward approach to banking without the obstacles – as it should be.

Money Jar makes things like setting up a bank account a lot more simple with just a few simple steps. First, download the Money Jar app, next, register your personal details and finally simply verify your identity using a standard form of identification such as a passport or driving licence.

We provide lots of ways to help you stay on top of your spending and make the process of setting up an account easy. Find out more about how we can help you have the freedom to be better with money and everything else you need to know about signing up for a digital account with Money Jar here.