Whether freelance for you means building and growing your very own business or taking on some specialised projects in place of your 9-5; if you have taken the leap and decided to work freelance or become self-employed in Ireland, one of the first things that you will want to figure out is your finances – this includes setting up a reliable freelancer or business bank account.

Like other types of bank accounts, the best freelancer bank account for you will totally depend on your own individual needs and circumstances. Below we have covered nearly everything you need to know about the top bank accounts for freelancers and self-employed in Ireland including if you should have a separate bank account for your freelance work and if you should open a business account for freelance work.

Can I use my personal account for freelance work in Ireland?

Let’s clear up one popular assumption – the belief that as a sole trader, you can continue to use your personal current account to receive payments and if you are a company (start-up or established), you must set up a separate business account.

While you may be able to continue to use your personal account as a sole trader, there are a few things to keep in mind:

- Depending on your bank’s terms and conditions, it may actually be a legal requirement that you do not use your personal account for business purposes

- Keeping your personal and business finances separate will make calculating your tax a lot easier

In short, it’s considered best practice to open a business account whether you are a freelance worker or a business so let’s look at your options!

Which bank account is best for freelancers?

The bank account that is best suited for one freelancer may not be best for you and your business. That is why we’ve highlighted some of the most popular business account providers including the benefits of each to make your decision process a lot easier.

You can sign up for a Bank of Ireland start-up account if you are a sole trader or limited company that started within the last three years.

Some highlights of the Bank of Ireland start-up account include:

- No maintenance or transaction fees for the first 2 years

- Wide range of business deposit options

- Support, tools and information to help your business start and grow

Find out more about the Bank of Ireland start-up account here.

The Permanent TSB business account does not offer any specific features or benefits for start-ups and may be best suited for more established businesses.

Some highlights of the Permanent TSB business banking account include:

- No transaction fees within Europe

- Access to their dedicated business banking team

- Pay wages or supplies in one transaction with bulk payments

Find out more about the Permanent TSB business banking account here.

AIB’s business start-up account is for start-ups and new businesses that have been trading for less than three years and are opening a business start-up account with AIB for the first time.

Some highlights of the AIB business start-up account include:

- No maintenance or translation fees for the first 2 years

- Merchant services allow you to take payment online, over the phone or in store

- Online service for small businesses

Find out more about the AIB business start-up account here.

How do I open a business account for freelance work?

As every bank is different, how you open a business account will depend on your chosen provider. Still, you can expect most banks to require the following documents and information:

- Verification of identity from the account holder eg. passport or driving license

- Proof of address from the account holder eg. utility bill

- Business licenses and articles of incorporation if you are a limited company

- Document showing that your company is registered with the Registration of Beneficial Ownership

Remember, the required documents can vary from provider to provider. The best way to know what you will need to open a business account is by reaching out directly to your chosen bank.

What should I look for in a bank account for freelance?

There are so many factors to consider before choosing the business bank account that’s right for you. Think about the fees, sign-up incentives, any maintenance requirements and the features that you consider must-haves (such as detailed statements or debit cards).

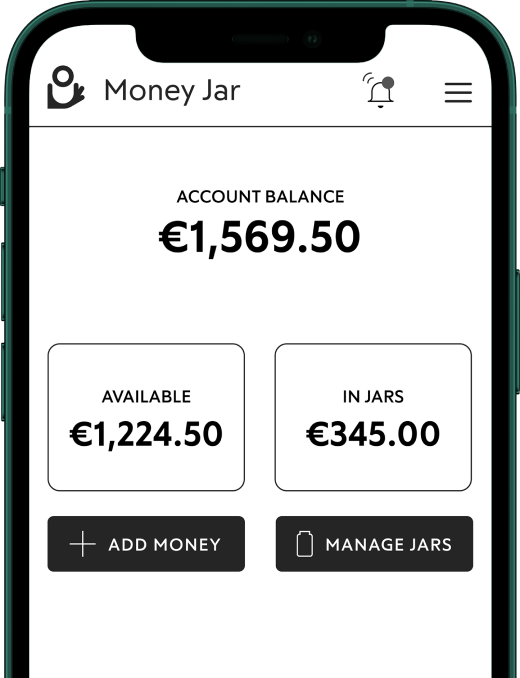

If you are a sole trader or freelance worker, why not consider a digital account with Money Jar? Move your money with the fastest technology available. Pay bills, set up standing orders, direct debits and transfer money in and out via SEPA. Find out more here.

Money Jar is a simple and straightforward approach to a digital account. We make things like setting up a bank account a lot more simple! First, download the Money Jar app, next, register your personal details and finally simply verify your identity using a standard form of identification such as a passport or driving license.

We provide lots of ways to help you stay on top of your spending and make the process of setting up an account easy. Check out MoneyJar.world to find out how we can help you have the freedom to be better with money and everything else you need to know about signing up for a digital account with Money Jar.