A direct debit is an automatic payment that gives a company permission to take money from your account on a specific date each month. Examples of direct debits you’re likely pretty familiar with include memberships or subscriptions such as Netflix or Spotify or bills like your phone or utility. When it comes to paying regular bills, direct debits are super helpful however scheduling the dates to set up your payments across the month and making sure there is enough money in your account to cover the payments can require some planning.

Below we cover everything you need to know about controlling direct debits, including the basics of setting up direct debits, the benefits, and how to cancel or move direct debits when necessary.

Setting up direct debits: The basics

Setting up a direct debit is usually a pretty straightforward process. The majority of the work will be done by the company that you’re setting up the direct debit with. You can expect to need to fill in a form with all relevant details and they will then notify your bank.

The details you will need to provide might include:

- Your full name

- The name and address of your bank

- Your bank account number

- Your bank account sort code

- Any other names on the account

How to arrange and control direct debits

While the majority of people have at least one direct debit, it’s pretty common to have more than one. And it probably goes without saying that when you do have multiple direct debits, organisation is key!

To keep on top of your direct debits and manage what’s coming in and out of your account, there are a few things to keep in mind, including:

- Set up direct debits during a time that you will have sufficient money in your account to comfortable make payments – this might be after payday for example

- Remember to regularly check in on the direct debits that you have set up – it can be easy to forget about a subscription you may have signed up for once and simply forgot to cancel

- Know that a company is required to notify you of any change to the amount or the date of the payment

Can I cancel direct debits?

Direct debits are almost easier to cancel than they are to set up. All you will need to do is contact your bank account either by phone or online and notify them of the specific direct debit you would like to cancel. It’s important to know that depending on your bank, they may require a certain notice period before your next payment is due – this can sometimes be as little as 1 day.

Can I move direct debits from one bank to another?

Choosing to switch bank accounts can bring with it a whole host of considerations – one of them of course being what happens to the direct debits you currently have set up. Across most banks in Ireland, there are two approaches you can take to move your direct debits from your old account to your new one.

- The Central Bank of Ireland switching code was set up to help make the process of switching bank accounts in Ireland a lot more simple – this includes moving your direct debits and other payments from your old account to another. You will usually just need to fill out an account transfer form to give your new bank permission to transfer any direct debits to your new account.

- You also have the choice to take control of the switching process yourself. This will mean making a list of regular payments and direct debits that come through your current account and updating them with your new bank details.

When switching accounts, don’t forget to choose a time of the month where activity is usually quite low. You can find out more about the ins and outs of switching bank accounts here.

What happens if I miss a direct debit payment?

If you don’t have enough money in your account to cover your direct debits, you can expect to possibly be charged by your bank or go into your overdraft. Of course, this entirely depends on your chosen provider.

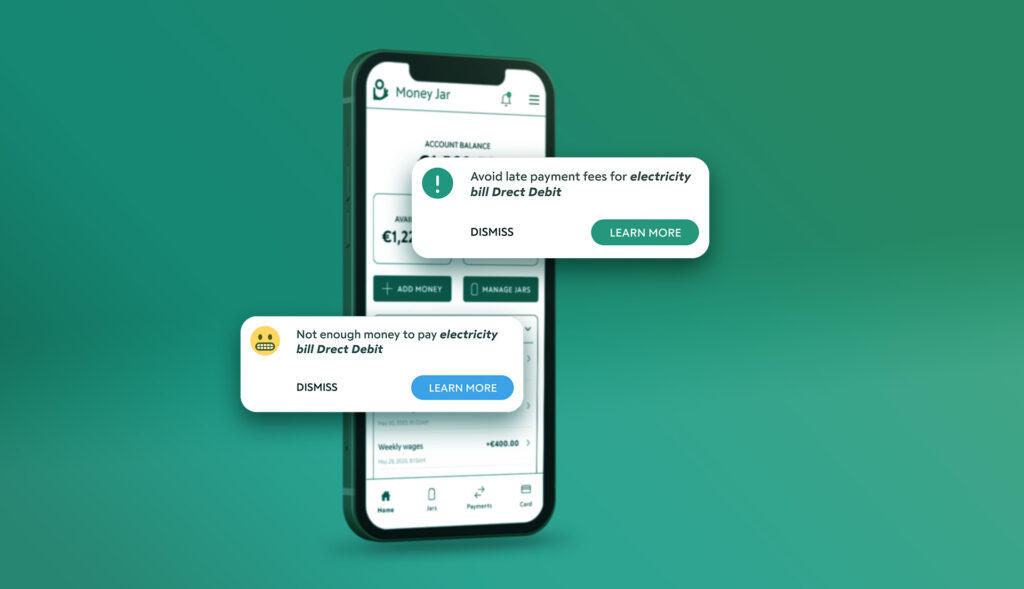

At Money Jar, our reminder feature is in place to help you avoid any missed direct debits. That’s right, rather than charging you without warning, we will notify you ahead of the direct debit due date if it looks like you might not have enough money in your account to cover it. If you do miss the direct debit, we will give you the opportunity to add the required amount before you get charged.

If you are on the lookout for a new and secure digital account, why not consider Money Jar? A simple and straightforward approach to a digital account.

Money Jar makes things like setting up a bank account much simpler with just a few steps. First, download the Money Jar app, next, register your personal details and finally simply verify your identity using a standard form of identification such as a passport or driving licence.

We provide lots of ways to help you stay on top of your spending and make the process of setting up an account easy. Find out more about how we can help you have the freedom to be better with money and anything else you might want to know about setting up a digital account with Money Jar here.