PayPal is one of the first companies set up to allow you to send money to friends, family, or business associates online. Once you set up a PayPal account, you can send or receive money from pretty much anyone, anywhere that has an account. Of course, this means that people carry out international money transfers every day with PayPal, but how does it work? Are there any catches you should be aware of?

Let’s dive into everything you should know about foreign exchange transfers with PayPal including converting your PayPal balance to another currency, if PayPal is cheaper than a bank transfer, and how foreign exchange transfers work with Money Jar.

Can I do a foreign exchange transfer on PayPal?

PayPal can be used for sending money abroad so if you need to make a payment that requires a currency conversion, you can do so with your PayPal account. Before making a payment, you will be shown the exchange rate however if you are making a payment with your bank card, you can choose to use your bank’s exchange rate instead.

If you would prefer to check the exchange rates ahead of time, find the currency calculator on your ‘wallet’ page in your account – doing this means that before you decide to make a transfer through PayPal you can get an idea of the currency conversion rate you might receive.

Can I convert my PayPal balance to another currency?

If you would like to convert money in your PayPal account balance you will need to:

- Go to your wallet and click ‘options’ beside the currency you want to convert

- Click on ‘convert currency’, choose the currency you want, and click next

- Choose the amount you want to convert, review the details and click convert now

How does PayPal calculate fees?

The fees charged by PayPal and how they are calculated vary depending on a number of factors including the amount you are sending and where you are sending it to. There are two types of fees that you are likely to come across when making payments with PayPal, including:

- Domestic fees: These are the fees charged by PayPal when making a transfer to a person in the same country. With a Money Jar account, you can use the app to make and receive instant money transfers to another Money Jar account for free, unlike other bank transfer methods.

- International fees: These occur when a transaction happens between two people from different countries (often referred to as different ‘markets’).

Money Jar strives toward full-fee transparency. This means you will always review the fees and exchange rate before confirming the transfer.

What is PayPal’s currency conversion fee?

The currency conversion fee with PayPal can vary between 3-5%. The conversion to US or Canadian dollars is around 3.5% and for other countries, it’s usually 4%. Keep in mind that PayPal is known to charge a fee for their conversion service which can come in at around 4.5%.

What is cheaper – bank transfer or PayPal?

It is difficult to give a straightforward answer as to whether you would be better off transferring money abroad using your bank account or PayPal account. There are a number of factors that may affect the fees and rates including the country you are transferring money to/from and your chosen provider and method of transfer.

What is the best PayPal alternative for foreign exchange?

There are now so many ways to transfer money abroad so if PayPal does not feel like the right fit for you, why not consider one of the following alternatives?

- Western Union allows you to send money to a bank account abroad through your credit card, debit card or cash. You can do this online or in person in one of their banks located across the country.

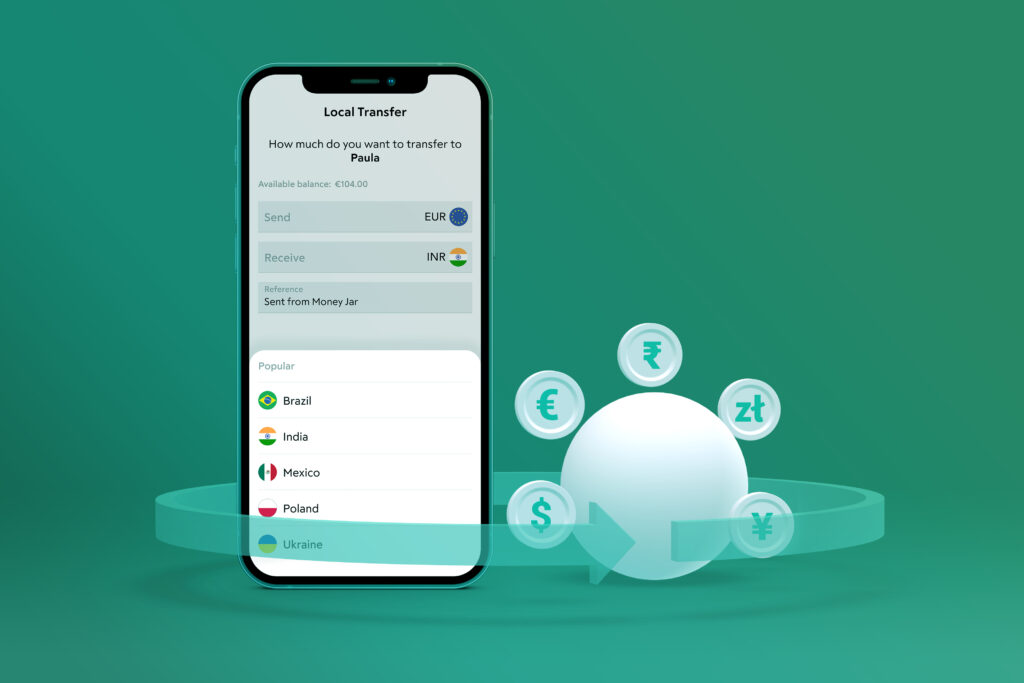

- Online Transfer is quickly becoming the preferred method of transfer for many. And while it includes transfer methods like PayPal, it also includes dedicated money transfer apps. If you prefer banking digitally and are interested in an account that caters to quick and simple money transfers across the EU and four international countries, learn more about Money Jar here.

Foreign exchange with Money Jar

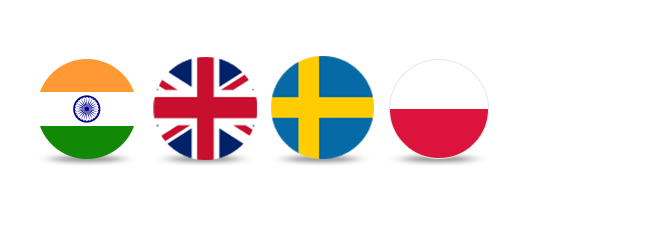

Money Jar customers can send money abroad with just a few simple clicks within the app. As well as being able to send EUR transfers inside the EEA, you can now send international payments to four countries: India, The United Kingdom, Sweden, and Poland. You will be able to use the local currency for each, find an overview below:

● India – EUR to INR (Indian Rupee)

● United Kingdom – EUR to GBP (British Pound)

● Sweden – EUR – SEK (Swedish Krona)

● Poland – EUR to PLN (Polish Zloty)

You will have full access to live information on the latest foreign exchange rates and times.

So, how do you make a transfer? It couldn’t be easier!

- Open the Money Jar app and click on the ‘Payments’ section at the bottom of the screen

- Click on ‘Foreign Exchange Transfer’

- Add a new account to transfer money to or use an existing one

- Enter the amount you want to send in EUR or the amount you would like your recipient to receive

- Before you confirm the transfer, the exchange rate and all relevant fees will be displayed

Find out more about how we can help you have the freedom to be better with money and everything else you need to know about signing up for a digital account with Money Jar here.