Do you need to transfer money to friends and family living abroad? Or maybe you are paying for overseas tuition fees? Whatever your reason for needing to transfer money internationally to or from Ireland, knowing the ins and outs of making an international transfer is key to making sure the process runs smoothly.

We have covered the most common questions asked about transferring money internationally and abroad from Ireland, including the basics of transferring money to a foreign bank account and the bank charges you might come across.

How do I transfer money to a foreign bank account?

So you need to send money abroad to or from Ireland – where do you begin? First things first, you are going to need the following information for the person or account you are transferring money to:

- The name and address of the recipient

- The bank account number or IBAN

- The BIC number or the full name and address of the recipient’s bank provider

Remember that depending on your particular bank, the information you need to make a successful transfer may differ – be sure to check with your provider ahead of time to avoid any complications.

What options are available for transferring money internationally?

Once you have the information you need, it’s time to choose the money transfer option that suits you best! There are now so many ways to transfer money to a foreign bank account which means there is bound to be one that suits your individual needs and wants. Some of the most common options include:

- A foreign bank draft, also sometimes known as a banker’s cheque, is almost like asking your bank to write a cheque for you. Your bank will verify and withdraw the cash from your account and deposit it into the international account. This can usually take anywhere from 1-3 business days.

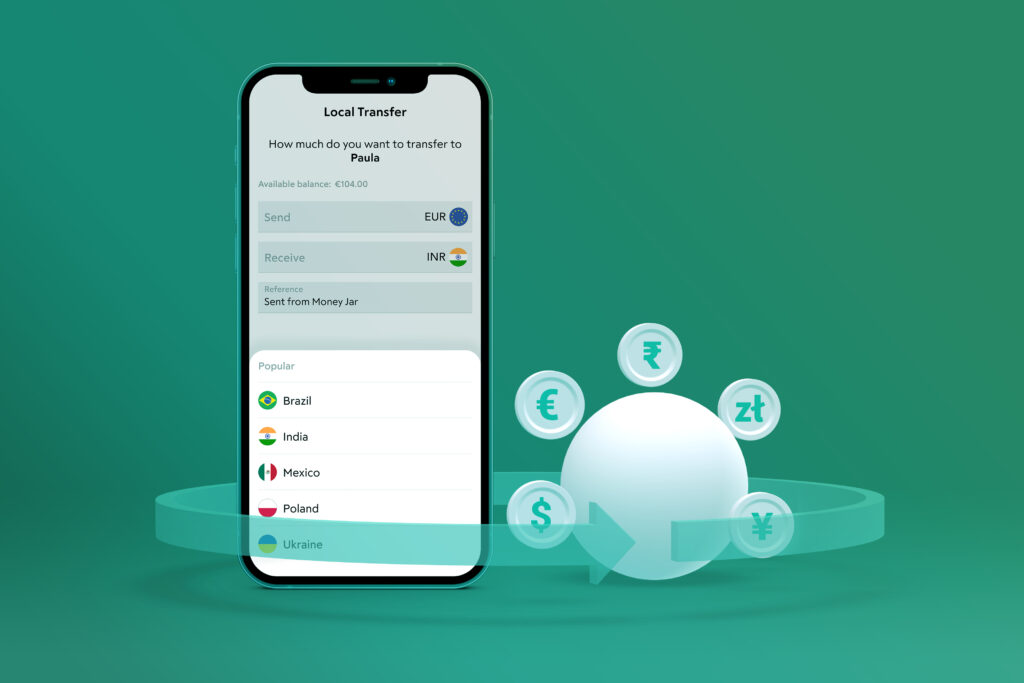

- An online transfer is an entirely electronic transfer of money between two banks. If your chosen provider has online facilities, you can do an online transfer with your online account or through the bank’s app, this is one of the most popular options used in recent years. With a Money Jar digital account, you can send EUR transfers inside the EEA and international payments to India, The United Kingdom, Sweden, and Poland. Find out more about what Money Jar can offer here.

- A money order is not as popular as it once was but it is still a method used to transfer money to a foreign bank account. You purchase a money order with cash or card, and the details of the recipient will be printed on the money order, and this will then be sent through the mail.

Do banks charge to send money internationally?

When you send money to a foreign bank account, it’s quite likely that your bank will charge a transfer fee. This transfer fee will depend on a number of factors, including your particular provider’s set fees and how much money you are sending.

It’s important to know that it’s also quite common for both the sender and receiver to pay the costs of the transfer. However, this too is dependent on the currency, destination and the chosen transfer method.

Are there complications when sending money abroad?

There can be some risks when it comes to sending money internationally but once you choose a safe and trusted method such as the options mentioned above, transferring money to a foreign account is safe.

If you are concerned about the safety of sending money to or from Ireland, remember the following tips to avoid money transfer scams:

- Don’t send money to someone you don’t know or trust

- Use a reputable money transfer service

- Check (and double-check!) the bank details of the recipient

Transferring money abroad with Money Jar

Money Jar is a simple and straightforward approach to a digital account. We make banking simple – exactly how it should be.

If you are looking to make transfers within the EU, you can do so simply with your Money Jar account via SEPA. The steps are pretty straightforward:

- Open the Money Jar app and go to ‘Payments’

- Select ‘Bank transfer out’ and add the SEPA details

Standard SEPA transfers with Money Jar usually take one business day while transfers done with SEPA Instant are done within seconds. It will depend on what the other bank supports, but Money Jar supports both. If you are sending from your Money Jar account to another, the transfer will come through within seconds.

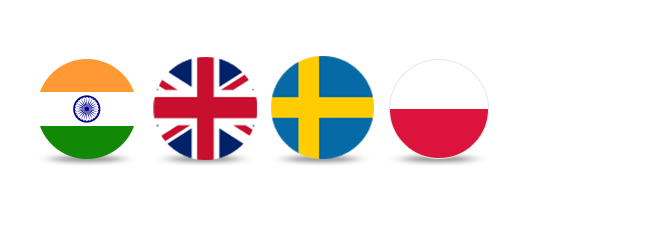

You can also send international payments to 4 countries. You will be able to use the local currency for all, find an overview below:

● India – EUR to INR (Indian Rupee)

● United Kingdom – EUR to GBP (British Pound)

● Sweden – EUR – SEK (Swedish Krona)

● Poland – EUR to PLN (Polish Zloty)

Support for more countries is planned as we see demand from our customers. You can expect a foreign exchange transfer with Money Jar to take up to 2 business days.

Find out how you can get started with a Money Jar digital account here.