Christmas is fast approaching. And even for the most organised amongst us, it can cause a whole host of worries; particularly surrounding expenses for presents, socialising and the number of other events that will inevitably end up on your list of to-dos. But what if we assured you that these worries can be minimized and the festive cheer can be maximized with just a few simple steps and a too-often overlooked word during this time of year: budgeting.

Avoid feeling flustered this season and follow Money Jar’s top tips for managing your money this Christmas to limit any post-holiday financial stress.

Managing your money over Christmas

#1 Know your money sources

First things first, what earnings do you expect to come in over the holiday period? If you are a full-time employee this may be a little more straightforward however if you are self-employed or a freelance worker, try your best to estimate your expected income over this time. Knowing what money you have coming in will make it a whole lot easier for you to get an idea of what money you would be comfortable coming out.

#2 Choose your priorities

During Christmas, the idea of priorities can get a little muddled. Social gatherings every weekend, big gifts for loved ones and small gifts for work secret Santa may all seem just as important as each other, but that’s not always the case! Setting priorities is all about deciding what is a must in your eyes vs an expectation in other people’s eyes. This means learning to say no to that extra night out and opting for a movie night in instead – something that is both easier on your bank account and your social battery.

#3 Make a list (and check it more than twice)

Put together a list of your usual and expected expenses over the course of Christmas. It probably goes without saying that this period can bring with it a whole host of out-of-the-ordinary expenses so it’s important to try your best to be aware of each to ensure you and your bank account aren’t caught off guard!

Of course, Christmas is different for everyone and it’s likely that your list will be too however, to get you started, it might be helpful to divide it into the following key categories: gifts, food, socialising and last-minute expenses.

#4 Create a budget

With your income, priorities and list all in mind, you can now put together a budget. This does not have to be too complex, just look at it as a way of keeping an eye on what is coming in and out of your account. This will make it easier for you to adjust your spending habits and review your spending throughout the lead-up and the aftermath of Christmas. You might consider using the same categories suggested for your list to divide up your Christmas budget (gifts, food, socialising and last-minute expenses.)

#5 Keep track of your spending

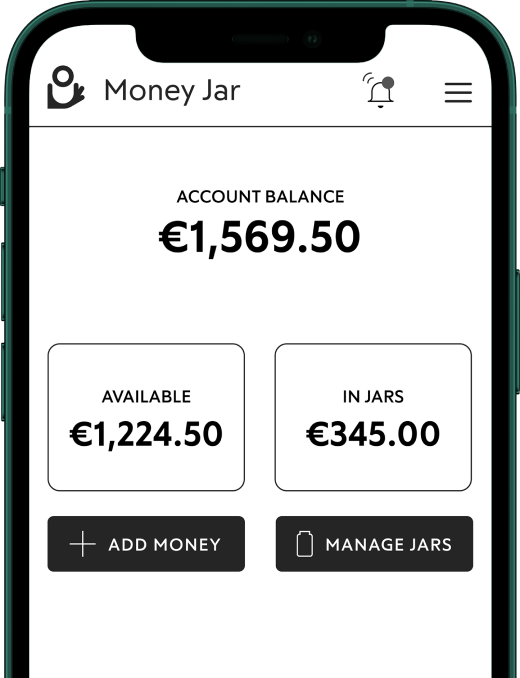

During Christmas, not everything goes to plan – even with a budget in place! That’s why it’s so important to regularly keep track of your spending and make sure you aren’t going above and beyond your budget and spending money on things that you agreed with yourself aren’t necessarily a priority. You can do this by regularly checking in on your account and maybe keeping your ‘Christmas funds’ in a separate place. With a Money Jar account, you can keep your cash safe in separate ‘Jars’ dedicated to each category of your expected expenses.

Manage your money every day of the year with Money Jar

At Money Jar, we recognise that Christmas budgeting can bring with it a whole host of stressors. That is why we have features in place that can help you keep on track with your budget during the Christmas period, and every time of the year.

With your Money Jar digital account, you will have access to Jars. These allow you to

- Put the money you need for fixed expenses like rent and other bills away and have them paid directly from the Jar

- Keep your money for agreed-upon expenses such as gifts, food, socialising and last-minute expenses safe and pay it out to your card as you need it

- Share a Jar with friends and loved ones for a night out or even a shared gift

Money Jar is a simple and straightforward approach to a digital account and has everything you need in place for keeping on top of your spending and budgeting.

We provide lots of ways to help you stay on top of your spending and make the process of setting up an account easy. Find out more about how we can help you have the freedom to be better with money and anything else you might want to know about setting up a digital account with Money Jar here.