So you have landed in Ireland, unpacked your bags and probably even tried a pint of Guinness. Next on the agenda? Getting your financial priorities in order to make adjusting to the Irish way of life a lot more trouble-free. That’s right, we’re talking about opening a resident bank account in Ireland.

Before you begin to feel overwhelmed – don’t! Setting up a bank account in Ireland is pretty simple and we’re here to provide you with everything you need to know, including what you need to open an Irish bank account and if you can set up an Irish bank account online.

What to know before opening a bank account

Before choosing and opening a bank account it’s important to know that there are two types of bank accounts: a current account and a deposit account (perhaps better known as a savings account).

A current account is the most common type of account offered by banks. With this type of account, you can manage your money and make day-to-day transactions. This will most likely be the type of account you will first set up when you settle on Irish soil.

A deposit account, or savings account, is a bank account where you can save and make deposits.

Other things to consider before choosing the right account and branch for you include:

- How you prefer to make transactions (cash withdrawal or bank transfer/card)

- How you would like to deal with the bank (online or in-person)

Who are the most popular current account providers in Ireland?

All major banks in Ireland offer current accounts however there are some current account providers that are more popular – this is usually because of the particular services or benefits they offer or the value of the charges or transaction fees.

Below we have highlighted some of the more popular current account providers in Ireland.

AIB is one of the largest and most popular banks in Ireland. Perks of signing up to AIB include a good mobile app and plenty of branches if you prefer to bank in person. However, a current account with AIB can be slightly more expensive than other banks and includes fees for things such as quarterly maintenance and ATM withdrawals.

Find out more about AIBs current account offerings here.

An Post is the national post office in Ireland and in recent years it launched its current account services. Some benefits include an up-to-date app and the option to set up saving targets and spending-related alerts. Like AIB, An Post can be a pricier option and includes monthly maintenance fees and some other extra fees.

Find out more about An Post’s current account offerings here.

Bank of Ireland is one of the leading banks in Ireland. Although its mobile app and mobile banking are not as advanced as AIB, they seem to be slowly working to modernize and improve their banking technology. Since 2020, they now charge a €6 monthly maintenance fee regardless of ATM withdrawals or other account activity, which should mean many customers will pay slightly less each month.

Find out more about Bank of Ireland’s current account offerings here.

How to open a bank account in Ireland

Opening a resident bank account in Ireland is relatively straightforward and can be done by either applying in your chosen bank’s branch or online. There are just a few documents that you will need to provide before you can apply for your account.

What do I need to open an Irish bank account?

You will need to provide the following documents to open an Irish bank account (you will need these whether you are applying online or in person)

- Proof of identity (eg. passport or driving licence)

- Proof of Irish address (eg. utility bill or a document issued by a government department or financial institution)

If you don’t have these documents, it might still be possible to open a non-resident account. Speak with your chosen branch to find out your options.

Can you open a bank account in Ireland when overseas?

It is possible to set up a non-resident bank account when you’re living overseas as a non-resident of Ireland. Proof of identity and proof of address in your residing country will usually be required. Other required documents may depend on your chosen bank branch.

What is the easiest bank account to open in Ireland?

Opening up a bank account in Ireland is pretty uncomplicated, however, if you would prefer the most simple and easy approach to setting up a current account in Ireland, Money Jar could be the best option for you!

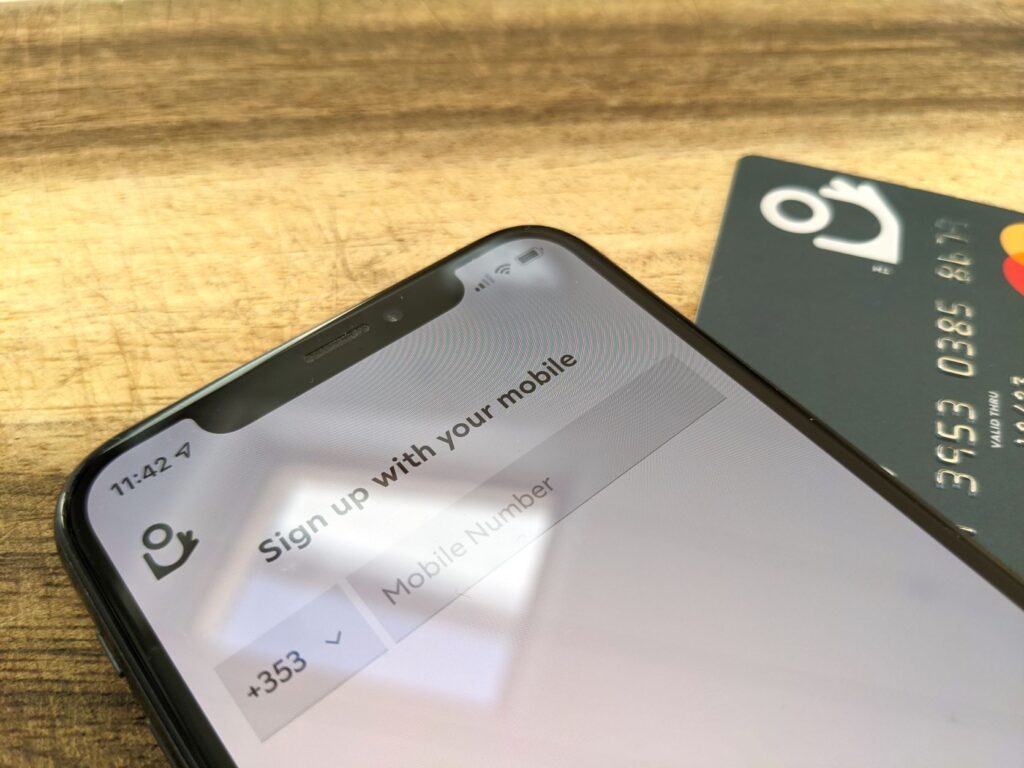

At Money Jar, we aim to help you to be better with money and reduce financial stress – including any stresses that can sometimes come with setting up a current account the traditional way. That’s why we built a simple new approach to a current account that is entirely digital with all the benefits. All you will need to set up an account with us is government-approved identification and a postal address to receive your prepaid Mastercard.

We recognise the importance of an Irish-backed business for safeguarding your money. Your money is always secure and held in Tier 1 Irish bank. Your Money Jar Prepaid Mastercard is issued by PFS Card Services (Ireland) Limited pursuant to a license from Mastercard International Incorporated.

At MoneyJar, we have built a simple new approach to a digital account. This means that things that can sometimes be confusing when first moving to a new country like setting up a bank account can all be made a lot more simple with three simple steps.

- Download the Money Jar app

- Register your personal details

- Verify your identity using a standard form of identification

We provide so many ways to help you stay on top of your spending and make the process of setting up an account easy – the way it should be! Find out more about how we can help you have the freedom to be better with money here.