When you think of sending money internationally, you likely think of the Western Union. With thousands of locations worldwide and 900 across Ireland, transferring your money to family or friends in a different country from Ireland with Western Union seems like an obvious decision! But, before you go ahead, there are a few things to know about international money transfers with the Western Union.

Let’s go through some of the most common questions about money transfers with Western Union in Ireland, including what you need for a Western Union transfer, the maximum amount you can send, and how you can transfer money across the EU and selected international countries with Money Jar.

How do you transfer money with Western Union?

Making a money transfer from Ireland with Western Union is pretty simple and involves just a few steps. Once you have gathered all the required information to make the transfer (more on that below!), you will need to:

- Choose how you would like to transfer your money: With Western Union, you now have a choice to send money abroad online, through the Western Union app, or in person in one of their locations. Find the closest Western Union near you here.

- Check the latest fees and rates: If you are sending money to a country with a different currency (for example from Ireland to India), make sure to check the exchange rates. You can do this on the Western Union website or at your local Western Union location.

- Decide how you would like the recipient to receive the transfer: Would you like the receiver directly to their bank account or as a cash pick up? In some countries, you can even send money directly to the recipient’s mobile wallet!

Once you have followed these steps, you can track the transfer online to ensure your money arrives safe and sound!

Can I transfer money with Western Union online?

Yes! You can now transfer money with Western Union online using either their website or through their app.

If you are interested in baking entirely digitally, transferring money to other EU countries within seconds, or sending money abroad to India, The United Kingdom, Sweden, or Poland, find out more about the digital account with Money Jar here.

What do I need for a Western Union transfer?

To begin, you will need to be 18 years old with a valid ID to both send and receive money through Western Union. In order to make an international money transfer, you will usually need the following documents:

- Your receiver’s bank name

- Your receiver’s bank code and bank account number

- The amount and currency you wish to send

The documents you need can depend on how your recipient would like to receive the money transfer. For example, if you are sending to a mobile wallet you will also need your phone number, the receiver’s phone number, and in some cases, their address.

It’s important to note that what you need for a Western Union transfer can vary so be sure to check in with your local agent to ensure the process goes as smoothly as possible!

How much is the Western Union transfer fee?

Money transfer fees can change depending on a number of factors including the amount of money being sent, the currency, and how you would like the recipient to receive the money. Of course, before you go ahead with the transfer, you will be given full visibility on how much you will pay for the exchange.

Is Western Union cheaper than bank transfer?

Whether Western Union is cheaper than transferring money through your bank provider is totally dependent on your particular circumstances, including your bank’s fees and conditions. Still, many are of the belief that Western Union transfer fees tend to be lower than a traditional bank with many banks offering weaker exchange rates than money transfer agents like the Western Union. You can find out more about Western Union transfer fees per country here.

If you are sending to another EU country, with a Money Jar account, you can use the app to make and receive instant money transfers to another Money Jar account for free. If you are sending to another EU/EEA account, you will be charged €0.20. Making a foreign exchange transfer with us? You will always review the fees and exchange rate before confirming the transfer.

How long does the Western Union transfer take?

How long your money transfer takes will be completely dependent on a number of variables including when you make the transfer and the country you are sending the money. According to the Western Union, however, you can expect a domestic transfer (a transfer between two different banks in the same country) to be completed within 24 hours. International transfers can take anywhere between 1-5 business days.

What is the maximum amount you can send with Western Union?

When sending in person at a Western Union agent location, you can typically send any amount but of course, there are some restrictions. For example, if you are sending or receiving over €15,000 during a one-year period you will need to share additional documents due to government regulations in Ireland. And, when sending more than €1,000 every 5 days online in Ireland, you will need to verify your identity.

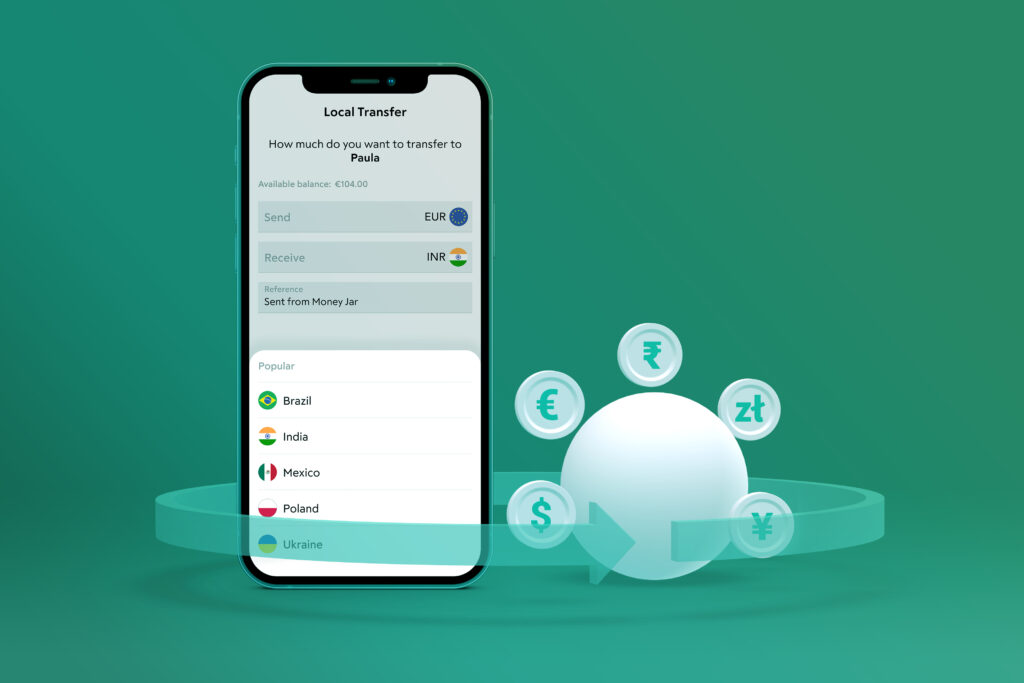

Transferring money with Money Jar

Do you prefer to handle your banking online? Why not consider a digital account with Money Jar! Our straightforward approach makes sometimes complicated banking matters, such as transferring money, a simple process.

This is what to expect when transferring money with a Money Jar digital account:

- To transfer money from your bank account to your Money Jar account, you can make a EUR bank transfer sent via SEPA. Simply confirm with your bank if they support SEPA payment methods.

- To transfer money from your Money Jar account to another bank account, you will again need to make a SEPA transfer. On the app, go to ‘payments’ on the bottom menu, select bank transfer out, and add in all required details.

- To make a foreign exchange transfer from your Money Jar account, using the app, click the ‘Payments’ section and click on ‘Foreign exchange transfer’, enter the amount you wish to transfer in EUR or the amount you wish for the recipient to receive. Exchange rates and all fees will be displayed before confirming the transfer.

- To transfer money from one Money Jar account to another, use the app to make and receive real-time, instant money transfers for free.

Standard SEPA transfers usually take one business day while transfers done with SEPA Instant are done within seconds – this entirely depends on what the other provider supports. When making a transfer from Money Jar, you can expect it to reach your recipient on the same business day if done before 1 pm local time.

You can send international payments to four countries: India, The United Kingdom, Sweden, and Poland. You will be able to use the local currency for some and USD for others. Support for more countries is planned as we see demand from our customers.